In real estate, understanding the Earnest Money Deposit (EMD) and its fees is crucial for investors and buyers. This article delves into how EMD fees function, highlighting their unique aspects in real estate transactions.

Transaction fees in EMD are a key element, covering the risks and administrative efforts involved in real estate transactions. Moreover, these fees, reflecting the high-risk nature of EMD, are essential for compensating lenders and ensuring efficient transaction management.

The short-term and high-risk nature of EMD sets it apart from traditional funding methods. The main risk lies in potentially losing the deposit if the transaction fails to close, a risk that traditional loans, with their thorough credit assessments, do not typically entail.

State laws govern EMD, outlining specific rules for managing and forfeiting these deposits. Each state’s real estate regulations dictate how to handle EMDs, and often requiring them to be held in escrow accounts. Resources from the National Association of Realtors can help understand state-specific laws.

Given EMD’s legal and administrative complexities, involving a transactional coordinator is often necessary, and it’s one of the reasons why EMD’s fees tend to be higher. This professional ensures correct handling of EMDs in line with state laws and contractual terms, managing the administrative tasks in these transactions.

Each real estate deal involving an EMD is unique. In addition, various factors influence the outcome, meaning results can vary significantly from one transaction to another.

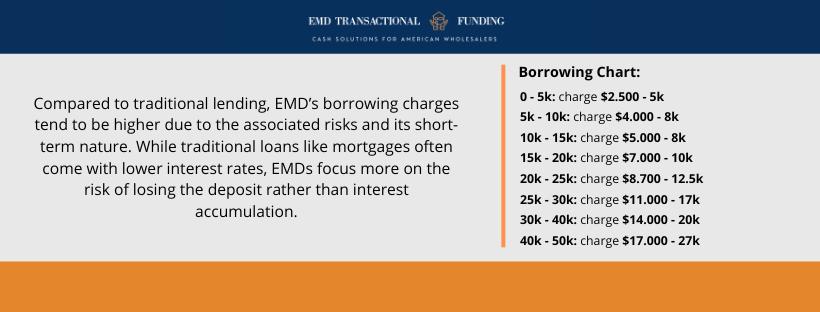

Compared to traditional lending, EMD’s borrowing charges tend to be higher due to the associated risks and its short-term nature. While traditional loans like mortgages often come with lower interest rates, EMDs focus more on the risk of losing the deposit rather than interest accumulation.

Also, the borrower is generally requested to pay for the wire transfer fee in case the deal doesn’t close. Some lenders might charge a penalty/unclose fee of $50 as minimum.

Know Your State’s Laws: Familiarize yourself with the specific regulations governing EMD in your state.

Risk Assessment: Carefully evaluate the transaction’s risk and your ability to close the deal successfully.

Prepare for Deal Variability: Acknowledge that each transaction is different, and outcomes can vary.

Financial Comparison: Understand the differences in costs between EMD and traditional lending methods.

EMD plays a vital role in real estate transactions, marked by its high-risk profile and short-term nature. Also, it significantly differs from traditional funding methods in terms of risks, legal requirements, and financial implications. While EMD demonstrates a buyer’s commitment, it requires careful handling due to the potential for loss and the varying legal requirements across states. With proper understanding and management, and the guidance of professionals like transactional coordinators, EMD can be effectively navigated. Finally, for more detailed information and assistance, consulting with real estate experts and legal advisors is recommended, especially for navigating specific state laws and complex transactions.

We follow and respect the principles of these recognized organizations, even if we are not formally affiliated with some of them.

COPYRIGHT © 2025 EMD TRANSACTIONAL FUNDING

A SERVICE PROVIDED BY GATOR EQUITY LLC.

emdtransactionalfunding.com offers fast and convenient EMD and double-closing funding services for real estate investors and wholesalers nationwide. To get the deposit you need for your next deal, fill out the form or reach out to our team!

A SERVICE PROVIDED BY GATOR EQUITY LLC.

COPYRIGHT © 2025 EMD TRANSACTIONAL FUNDING